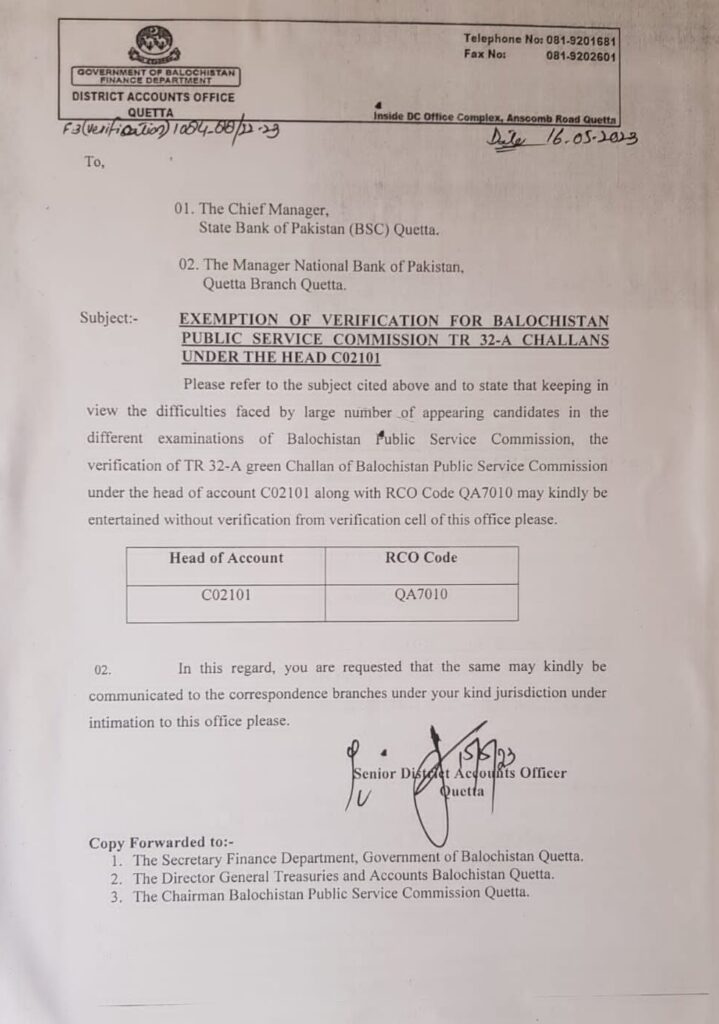

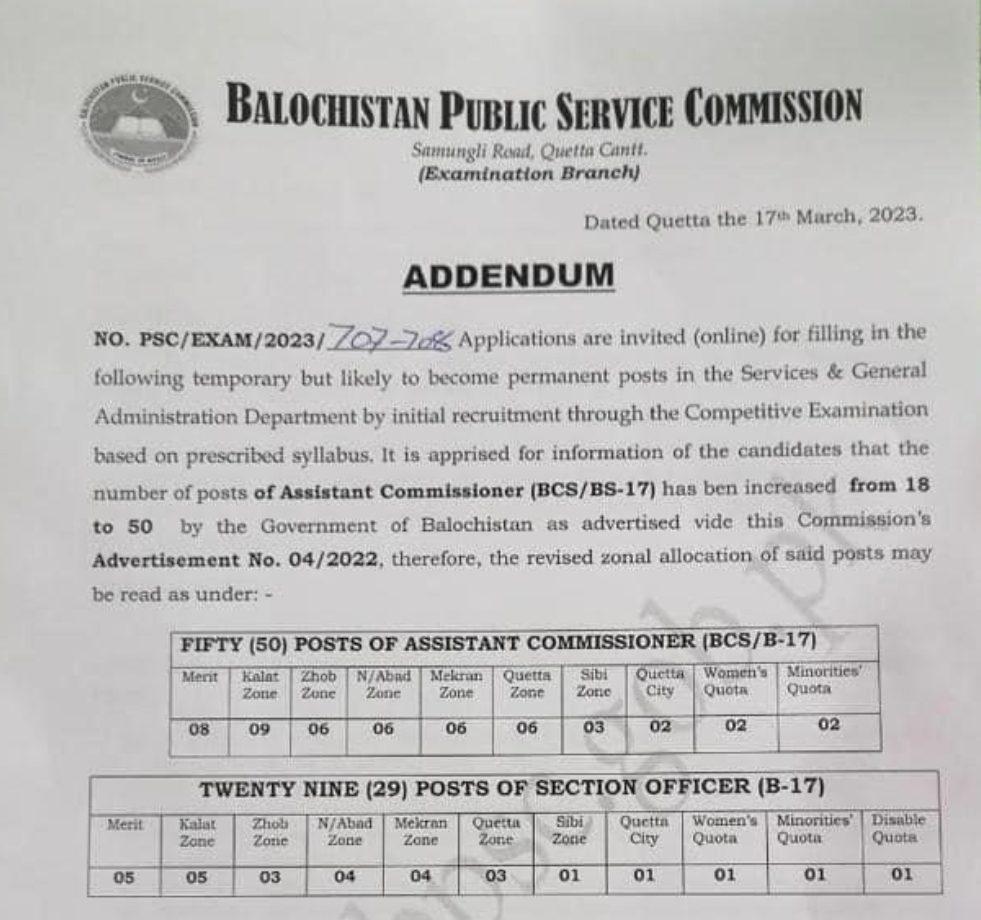

BPSC Bank Challan Form 2023: EXEMPTION OF VERIFICATION FOR BALOCHISTAN PUBLIC SERVICE COMMISSION TR 32-A CHALLANS UNDER THE HEAD C02101

It is good news for the BPSC Quetta aspirants that the Finance Department Government of Balochistan has exempted the verification for Balochistan Public Service Commission Quetta, TR- 32-A challans under the head C02101.

As the verification process is hectic for the students and youth. It was not only time wasting activity but also a hard process. Most of the students are not much aware of different offices as they are busy with their studies.

Exemption of Verification for TR 32-A Challans in BPSC

In the context of the Balochistan Public Service Commission (BPSC), there is an exemption of verification for TR 32-A challans.

Understanding TR 32-A Challans

TR 32-A challans are a specific type of payment form used in the BPSC Quetta. These challans are utilized by individuals who are submitting fees or payments related to BPSC examinations, application processing, or any other services provided by the commission. The TR 32-A challan acts as proof of payment and helps in the proper allocation and record-keeping of funds by the BPSC Quetta.

Exemption of Verification for TR 32-A Challans (BPSC bank challan form 2023)

Unlike other provincial challans that require verification by the Treasury Officer (TO) or District Accounts Officer (DAO), there is an exemption of verification for TR 32-A challans in the BPSC. This means that individuals submitting fees or payments using TR 32-A challans for BPSC Quetta are not required to undergo the additional step of verification by the TO or DAO.

The exemption of verification for TR 32-A challans streamlines the payment process for BPSC-related transactions. It eliminates the need for individuals to visit the Treasury Office or the District Accounts Office for verification, saving both time and effort.

However, it is essential to note that this exemption is specific to TR 32-A challans used in the BPSC. Other provincial challans for different purposes may still require verification as per the standard procedures set by the respective government authorities.

BPSC online applyhttps://shalkot.com/job/latest-jobs-in-bpsc-quetta/

Implications and Benefits of the Exemption

The exemption of verification for TR 32-A challans in the BPSC offers several implications and benefits:

- Simplified Process

By exempting the verification step, the BPSC provides a simplified payment process for individuals. They can directly submit their fees or payments using TR 32-A challans without the need for additional verification, reducing bureaucratic hurdles.

- Time and Effort Saving

The exemption saves valuable time and effort for applicants and candidates participating in BPSC examinations or availing of BPSC services. They can complete their payment process swiftly without the need to visit multiple offices for verification.

- Enhanced Efficiency

With the exemption, the BPSC can enhance its operational efficiency. The elimination of the verification step streamlines the internal processes and reduces administrative burdens, enabling the commission to focus on other critical tasks.

- Improved User Experience

The exemption of verification for TR 32-A challans contributes to an improved user experience for individuals associated with the BPSC. The simplified payment process enhances convenience, making it more user-friendly and accessible.

Conclusion

In conclusion, there is an exemption of verification for TR 32-A challans in the BPSC. Unlike other provincial challans, individuals using TR 32-A challans for BPSC-related payments are not required to undergo the verification process by the Treasury Officer (TO) or District Accounts Officer (DAO). This exemption simplifies the payment process, saves time and effort, and contributes to enhanced efficiency and user experience. However, it is crucial to note that this exemption is specific to the BPSC and may not apply to other provincial challans for different purposes.

The notification (1084-88/22-23) of the Finance Department Government of Balochistan is subjected as EXEMPTION OF VERIFICATION FOR BALOCHISTAN PUBLIC SERVICE COMMISSION TR 32-A CHALLANS UNDER THE HEAD C02101 and further states “Please refer to the subject cited above and to state that keeping in view the difficulties faced by a large number of appearing candidates in the different examinations of the Balochistan Public Service Commission, the verification of TR 32-A green Challan of Balochistan Public Service Commission under the head of the account C02101 along with RCO Code QA7010 may kindly be entertained without verification from verification cell of this office, please.”

Head of Account for BPSC bank challan form 2023:

The following heads of accounts are exempted.

- RCO Code

- C02101

- QA7010

- 02

Further, the said notifications advise “In this regard, you are requested that the same may kindly be communicated to the correspondence branches under your kind jurisdiction under intimation to this office, please”.

The notification was moved by Senior Diet Accounts Officer, Quetta. And a copy of the notification is also forwarded to:-

- The Secretary of Finance Department, Government of Balochistan Quetta. 2. The Director General Treasuries and Accounts Balochistan Quetta.

- The Chairman Balochistan Public Service Commission Quetta.

For all kinds of provincial challans (Balochistan) to be paid in State Bank of Pakistan (BSC), Quetta, and National Bank of Pakistan, Quetta, it is mandatory that the challan should be verified by the Treasury officer (TO) or District Accounts Officer (DAO). Dealing with provincial challans can be a daunting task, especially when it comes to ensuring proper verification and payment. In Balochistan, for all kinds of provincial challans to be paid in the State Bank of Pakistan (BSC), Quetta, and National Bank of Pakistan, Quetta, it is mandatory that the challan should be verified by the Treasury Officer (TO) or District Accounts Officer (DAO). This article serves as a comprehensive guide to help individuals navigate through the process smoothly, providing insights into verification requirements, payment guidelines and frequently asked questions.

For All Kinds of Provincial Challans (Balochistan) – Verification Process

For all kinds of provincial challans (Balochistan) to be paid in State Bank of Pakistan (BSC), Quetta, and National Bank of Pakistan, Quetta, the verification process is a crucial step to ensure the validity of the challan. Here’s an overview of the process:

1. Visiting the Treasury Office

To initiate the verification process, visit the nearest Treasury Office in your district. The Treasury Officer (TO) or District Accounts Officer (DAO) will guide you through the necessary steps.

2. Submission of Challan and Documents

Submit the challan and the required supporting documents to the Treasury Officer (TO) or District Accounts Officer (DAO) for verification. Ensure that all the details are correctly filled in the challan, as any errors may cause delays or complications in the process.

3. Verification by the Officer

The Treasury Officer (TO) or District Accounts Officer (DAO) carefully reviews the challan and the accompanying documents to verify their authenticity. They cross-check the details, ensuring that the payment is directed to the correct account and the appropriate fee has been calculated.

4. Seal and Signature

Upon successful verification, the Treasury Officer (TO) or District Accounts Officer (DAO) will affix an official seal and signature on the challan. This seal acts as proof of verification and is essential for payment processing.

5. Payment Submission

With the verified and sealed challan in hand, proceed to the State Bank of Pakistan (BSC), Quetta, or National Bank of Pakistan, Quetta, to make the payment. Present the challan to the bank officer, who will guide you through the payment process.

6. Acknowledgment Receipt

Once the payment is successfully processed, the bank will provide you with an acknowledgment receipt. Retain this receipt as proof of payment for future reference.

Payment Guidelines for Provincial Challans (Balochistan)

To ensure a smooth payment process, adhere to the following guidelines:

1. Payment Method

Provincial challans in Balochistan can be paid through cash, demand draft, or pay order. Confirm with the Treasury Officer (TO) or District Accounts Officer (DAO) which payment method is acceptable for your specific challan.

2. Payment Location

As mentioned earlier, provincial challans can be paid at the State Bank of Pakistan (BSC), Quetta, or the National Bank of Pakistan, Quetta. Visit the nearest branch of either bank to complete the payment.

3. Correct Amount Calculation

Calculate the payment amount accurately to avoid any discrepancies.

4. Deadline for Payment

Ensure that the payment is made within the specified deadline mentioned on the challan. Late payments may result in penalties or additional charges.

5. Retain Payment Proof

Always keep a copy of the verified challan, along with the acknowledgment receipt provided by the bank, as proof of payment. These documents may be required for future reference or any potential disputes.

6. Additional Requirements

Some challans may have specific additional requirements, such as attaching supporting documents or providing additional information. Double-check the instructions provided on the challan and fulfill all the necessary requirements before submitting for verification.

Frequently Asked Questions (FAQs)

Here are some common questions related to the verification and payment process for provincial challans in Balochistan:

- Is it mandatory to get the challan verified by the Treasury Officer (TO) or District Accounts Officer (DAO) for all provincial challans in Balochistan?

Yes, for all kinds of provincial challans (Balochistan) to be paid in the State Bank of Pakistan (BSC), Quetta, and National Bank of Pakistan, Quetta, it is mandatory to get the challan verified by the Treasury Officer (TO) or District Accounts Officer (DAO).

- Can I pay the provincial challan at any bank branch in Balochistan?

No, provincial challans can only be paid at the designated branches of the State Bank of Pakistan (BSC), Quetta, and the National Bank of Pakistan, Quetta.

- What happens if I don’t get the challan verified before making the payment?

If the challan is not verified by the Treasury Officer (TO) or District Accounts Officer (DAO) before payment, it may result in the rejection of the payment or complications in further processing.

- Can I make the payment online for provincial challans in Balochistan?

Currently, online payment options for provincial challans in Balochistan may not be available. It is recommended to visit the designated bank branches for payment.

- What should I do if there is an error in the challan after verification?

If you discover any errors in the challan after verification, immediately inform the Treasury Officer (TO) or District Accounts Officer (DAO) and follow their guidance to rectify the issue.

- Is there a specific time frame within which the payment needs to be made after verification?

While the specific time frame may vary depending on the nature of the challan, it is essential to make the payment within the deadline mentioned on the verified challan to avoid any penalties or delays.

Conclusion

In conclusion, for all kinds of provincial challans (Balochistan) to be paid in the State Bank of Pakistan (BSC), Quetta, and National Bank of Pakistan, Quetta, it is mandatory that the challan should be verified by the Treasury Officer (TO) or District Accounts Officer (DAO). The verification process involves submitting the challan and supporting documents, followed by a thorough review by the officer. Once verified, the challan can be presented for payment at the designated bank branches. Adhering to the payment guidelines, such as using the correct payment method, meeting deadlines, and retaining proof of payment, is crucial. By following these procedures and guidelines, individuals can ensure a smooth and hassle-free experience when dealing with provincial challans in Balochistan.

Heads of Account for Provincial Challan Payments

There are a number of heads of account against which the amount is paid by individuals and institutions. A large amount of cash is collected by State Bank and National Bank on behalf of the government for different sectors, either tax or customs duty, exam fees, etc.

A Variety of Heads of Account for Provincial Challan Payments

When it comes to provincial challan payments in Balochistan, there are numerous heads of account against which individuals and institutions make their payments. State Bank of Pakistan (BSC), Quetta, and National Bank of Pakistan, Quetta, serve as intermediaries, collecting a significant amount of cash on behalf of the government for various sectors, including taxes, customs duties, exam fees, and more.

Here are some common heads of account under which payments are made:

- Taxes

Under this head, individuals and businesses make payments for various taxes, such as income tax, sales tax, property tax, and other levies imposed by the provincial government.

- Customs Duties

Customs duties include payments made for the import or export of goods, customs clearance fees, and other charges related to customs regulations.

- Examination Fees

Students appearing for provincial board exams or other educational assessments are required to pay examination fees under this head of the account.

- License and Registration Fees

Payments made for obtaining licenses and registrations fall under this category, including professional licenses, vehicle registrations, business permits, and more.

- Fines and Penalties

Individuals who have incurred fines or penalties due to various violations, such as traffic offenses, late fee submissions, or non-compliance with government regulations, are required to pay under this head of the account.

- Government Services

Payments for availing government services, such as application processing fees, document attestation charges, and other administrative expenses, come under this head.

- Education and Institutions

Fees paid for educational institutions, including schools, colleges, universities, and vocational training centers, are categorized under this head of account.

- Utilities and Services

Payments for utilities such as electricity bills, water charges, sewerage fees, and other essential services provided by the government fall under this category.

- Health and Medical Services

This head of the account covers payments made for medical services, including hospital bills, diagnostic tests, treatment expenses, and healthcare facilities.

- Grants and Contributions

Individuals or organizations contributing funds or making donations to government initiatives, welfare programs, or charitable causes make payments under this head of the account.

It is important to note that these are just a few examples of the heads of account for provincial challan payments in Balochistan. The specific heads of account and their respective codes may vary depending on the nature of the payment and the regulations set by the provincial government.

By correctly identifying the relevant head of account and providing the necessary details in the challan, individuals ensure that their payments are properly allocated and accounted for by the government.

Address:

GOVERNMENT OF BALOCHISTAN FINANCE DEPARTMENT

DISTRICT ACCOUNTS OFFICE QUETTA Fa(verification) 1004.08/23-53

Inside DC Office Complex, Anscomb Road Quetta

Contact Number:

Telephone No: 081-9201681 Fax Not 081-9202601

BPSC JOBS

BPSC green challan download

BPSC bank challan form 2023 cannot be directly downloaded from BPSC Quetta’s Official Website but the challans are available in DISTRICT ACCOUNTS OFFICE QUETTA only. You have to visit DAO to get challan. There should be four pages for each challan.

How to fill BPSC green challan?

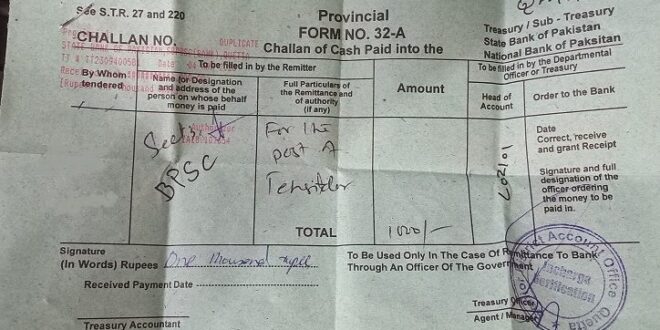

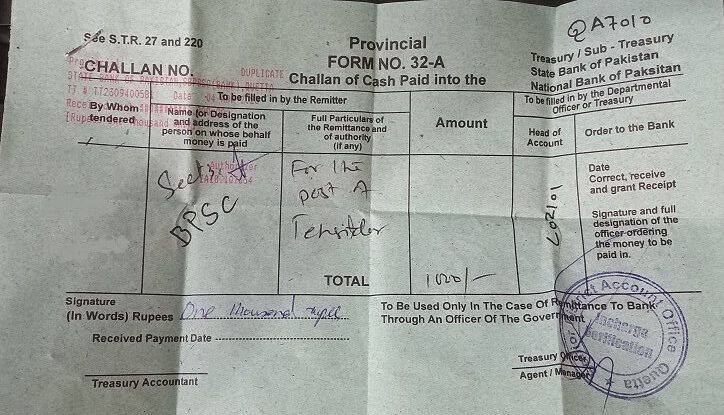

If you want to know how to fill BPSC challan form, please go through the below-given image the BPSC challan form fill sample is given below.

1. By Whome Tender:

In this section, you have to write the name of the candidate who is going to appear in the examination.

2. Name or Designation and address of the person whose behalf money is paid

In this section you will mention, Chairman BPSC Quetta or Sectary BPSC Quetta.

3. Full Particulars of the Remittance and of authority (if any)

You have to write the desired post for which the applicant is submitting the fee, in this section. As in the below-given BPSC bank challan form 2023, the fee is paid for the post of Tehsildar BPS-16

4. Amount

The fourth column is asking about the amount which you are going to submit against the desired post. Please check the BPSC Jobs advertisement carefully and write the exact amount required for each post. The amount of the fee is not fixed as it varies with the pay scale (BPS).

5- Head of Account

In the head of the account section, you have to write C02101 as this is the head of the account of BPSC bank challan form 2023 Quetta.

Please mind it the head of the account C02101 is only BPSC Quetta only.

Shalkot The Innovators

Shalkot The Innovators